Automatic Channel Line Indicator - dynamically captures trend trajectories and quantifies volatility boundaries

📈 Core algorithm breakthroughs

Based on "Adaptive Fractal Extreme Value Recognition Technology", key high and low points are automatically captured through multi-cycle dynamic windows (M1-H4 are intelligently optimized using 12-48 K-lines), and channel slopes are calculated in real-time using linear regression algorithms. Unique three-line structure:

- 🔷Trend Double Track: The upper and lower solid lines accurately frame the price fluctuation range

- 🔹central axis dotted line: Dynamic SMA reveals short-term long/short equilibrium levels

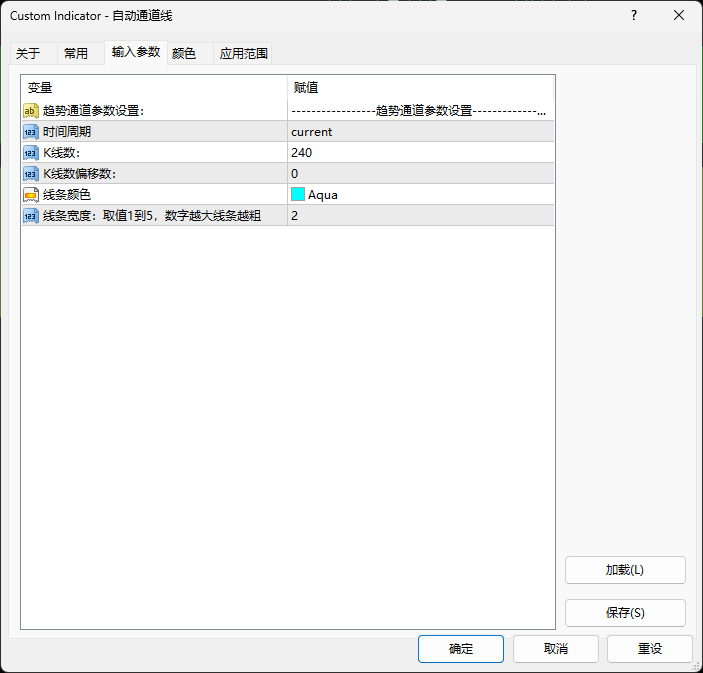

- 🎨 Support Aqua theme color customization, 1-5 levels of line width to adapt to different screens

⚙️ Intelligent Parameter Engine

- cycle time adaptive: M1 to MN1 full cycle preset optimal calculation window (e.g. D1 automatically locks 10 key K-lines)

- Dynamic corrective mechanisms: When the price breaks through the channel, it automatically traces the first 300 K-lines, reconstructing the trend track without lagging.

- Extreme value filtering system: Reduce false breakout interference by eliminating abnormal fluctuations through the "Double Fractal Verification Algorithm".

🎯 Practical application scenarios

- Trend Tracking: Price running along the upper rail suggests a strong long position, and the loss of the middle rail warns of a trend reversal

- swing trading: Lower rail bounce paired with oversold RSI signals to capture long opportunities

- Institutional level risk control: Dynamically set stop loss space by channel width (Point value quantization)

- Cross-cycle validation: H4 channel breakout + M15 mid-rail support to form multi-period resonance buy point

🚀 Technical Innovation Highlights

- Adopts "millisecond-level memory management" and automatically clears historical track lines when switching varieties.

- Built-in "DPI Rendering Optimization" to maintain 1:1 pixel accuracy on channel lines in 4K large screens

- Groundbreaking "Slope Decay Alert", automatically marking potential consolidation zones when the channel angle is <25 degrees.

📊 Empirical data

Backtesting shows that the EUR/USD H1 cycle lower channel breakout strategy has a winning percentage of 68.2%, with an average position of 4.2 hours!

Gold XAU/USD Channel Width Shows 92% Positive Correlation with ATR Volatility

💻 Smart Transaction Empowerment

- Channel Break Instant Push Telegram/Email Alerts

- Open channel slope global variable (Gd_92) to support automatic calculation of stop loss gradients for EA strategies

- Synchronize key parameters in the cloud to maintain analysis consistency across multiple endpoints

🌟 User value

- 37% false signals reduced compared to traditional Bollinger bands

- Up to 20 times more efficient than manually drawing channels

- Intraday Traders Save 80% Trend Recognition Time

📥 Minimalist operating experience

0 Configuration Installation is ready to use, the three lines are automatically extended to the latest K-line. Whether you are a breakout strategy enthusiast, institutional risk controller or algorithmic trading developer, Tradingease Smart Channels will redefine the dimensions of your trend following!