SGD Harvester is one of the TradingeaseEA Harvester series, an efficient and advanced SGD AUD, NZD, CAD Currency Currency Exchange Grid EA. In forex trading, grid strategies are popular due to their flexibility and potential for high returns. However, many traditional lattice EAs suffer from over-optimization, often over-fitting historical data in order to perform well in historical backtesting. Such strategies are prone to exposure in real trading, especially in the face of dramatic market volatility. New Coin Harvester does away with these drawbacks of traditional grid systems and handles trades in a smarter and more robust manner. Instead of relying on overfitting historical data, it focuses on capitalizing on the volatility of real market conditions to capture trading opportunities. It searches for reasonable profits amidst market volatility, while tightly controlling trading risks and ensuring the applicability of trading strategies in different market conditions. It is suitable for traders who are looking for solid returns and have a high regard for risk. Whether you are new to the forex market or an experienced trader, SGX Harvester provides you with a secure and efficient trading solution.

Main features

- Easy setupThe risk control parameters are basically built-in by default, no need to make additional adjustments, a chart runs to manage all trading varieties, no need to load the EA several times, the key parameters are set by default, no need to repeatedly fumble with the trial adjustments.

- risk managementUnlike traditional grid strategies, TradingEase - SGD Harvester takes risk management very seriously. It limits possible losses by placing strict stop-loss and take-profit on each trade, and locks in gains in the event of a profit. In addition, TradingEase-SGD Harvester controls the maximum account retracement to ensure that profits are maximized while minimizing risk.

- Intelligent Volatility Capture, algorithms make trading decisions based on real-time market volatility. Whether the market is in a trending volatility or an oscillator phase, it is possible to adjust the trading strategy in a timely manner, thus increasing the likelihood of profitability;

- No reliance on historical optimizationThe unique feature of TradingEase - New Coin Harvester is that it does not over-optimize the strategy for historical backtesting results. This means it performs more realistically and robustly in real-time trading, reducing the risk of strategy failure due to changing market conditions.

Parameter description

- Handicap Calculation: 8 built-in position management methods: 1~4 for preset level lot, 5~7 for set lot according to account capital, 8 for fixed lot.

- Trading Currency Pairs: Only for AUDNZD,AUDCAD,NZDCAD three currencies trading, according to the account trading product suffix corresponding to the adjustment.

- maximum retracement: Maximum retracement values are set for accounts & strategies, and risk control actions are taken accordingly.

- Open Position Direction: Whether only long or short orders, or both long and short, are allowed.

- Maximum spread, slippage: Maximum spread, slippage allowed for trading.

- Number of currencies allowed to be traded at one time: Maximum number of product classes in which positions are permitted.

- Hedge Switch: Long and short positions in the same product are permitted in both directions.

- Minimum Available Margin: The minimum amount of margin remaining after the setting, and no more positions will be opened after it is reduced to the set value.

- Percentage of maximum floating retracement, backtesting of funds: Maximum retracement allowed (in percentage and absolute value), reaching which triggers the action.

- Retracement calculation method::Strategy dimension: first round of funding calculation for each new strategy, account dimension: calculated according to the account funds as a whole.

- Pullback Trigger Action: Risk control behavior performed after the set maximum retracement has been reached.

- Initial Take Profit Points: Take-profit point for the initial trade (if grid trading is not enabled).

- Weighted Take Profit Switch: Whether or not to use a weighted take-profit.

- Grid Take Profit Points: Grid take-profit points, if set to 0, the overall order take-profit is a weighted take-profit mode, i.e. equal to the take-profit point setting of the initial order as described above.

- Number of capital preservation stop start orders: Enable capitalization-weighted price exit when the number of orders for a particular product position reaches a set value.

- Hide Stop Loss, Take Profit: Stop Loss and Take Profit are not shown in the order when it is opened.

- Grid Stop: Overall stop loss pips when grid additions are enabled. Default 0 is 1000 pips.

- Points between position increases: Minimum number of points between grid (average) trades.

- Intelligent Positioning Interval: Automatically adjusts trading distances in response to market fluctuations.

- Maximum number of trading orders: Maximum number of layers of the grid / number of orders.

Recommended settings

- capital: 3000 USD

- Load Chart: AUDCAD

- operating cycle: 15min

- Handicap Algorithm: (100x leverage) High-risk strategies available

- Open Position Direction: Long-Short Bidirectional

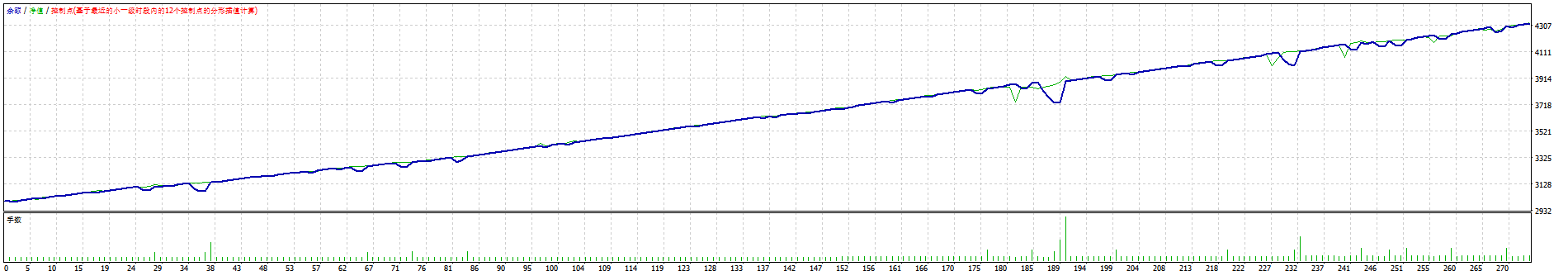

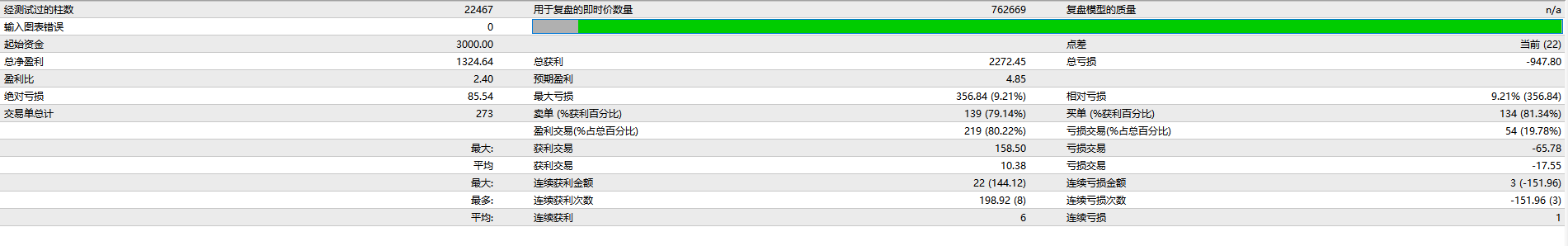

Backtest Information

| Backtesting funds | Handicap Algorithm | Open Position Direction | cyclicality |

| 3000 | high risk strategy | both sides of the coin | M15 |

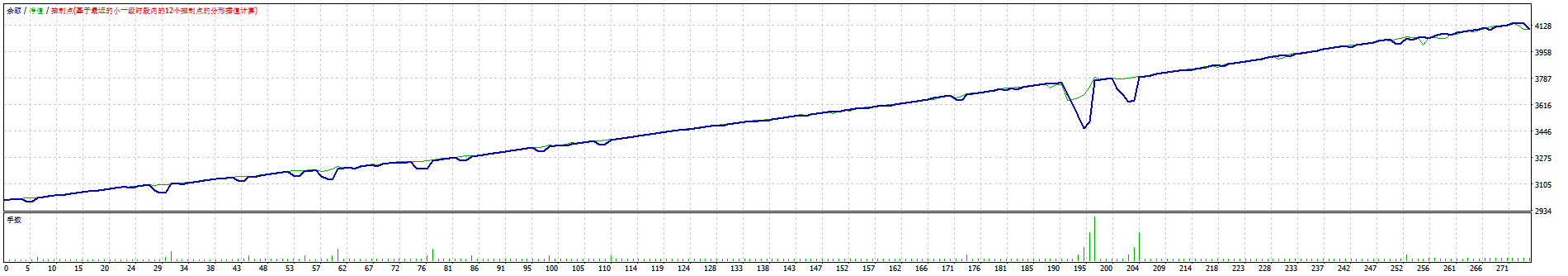

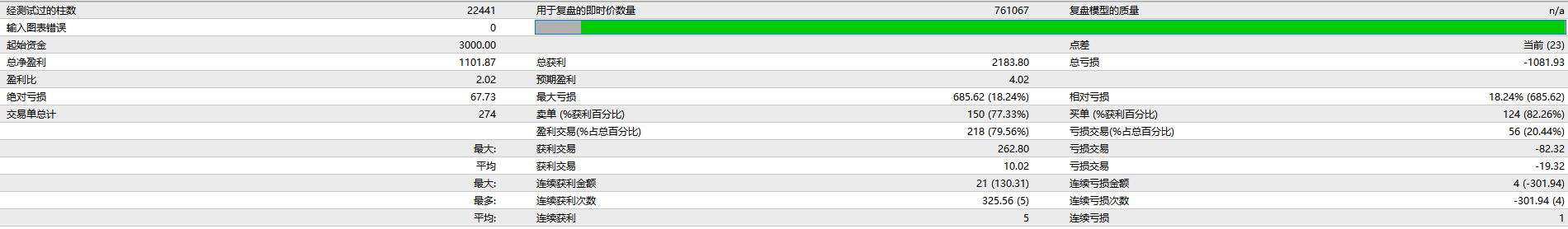

1. High-risk strategies

AUDCAD

| profitability | earnings yield (finance) | break-even ratio | maximum retracement | Total number of orders traded | Percentage of profitable trades | Percentage of losing trades |

| 1101.87 | 36.72% | 2.02 | 18.24% | 274 | 79.56% | 20.44% |

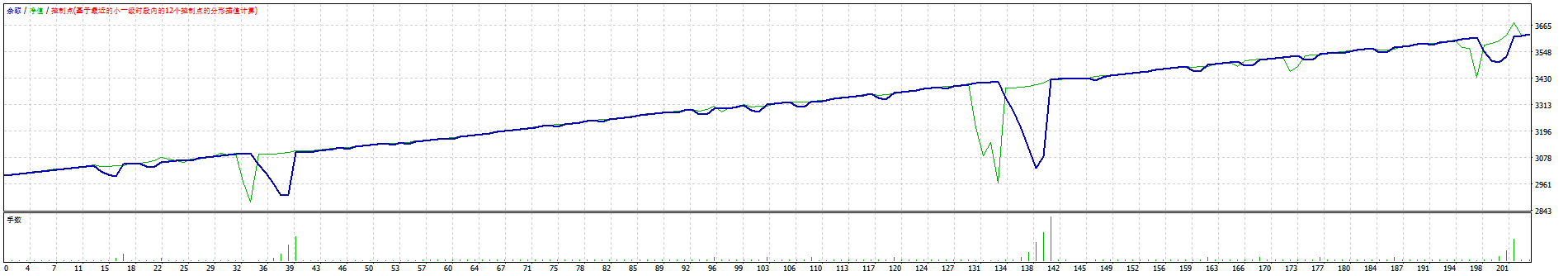

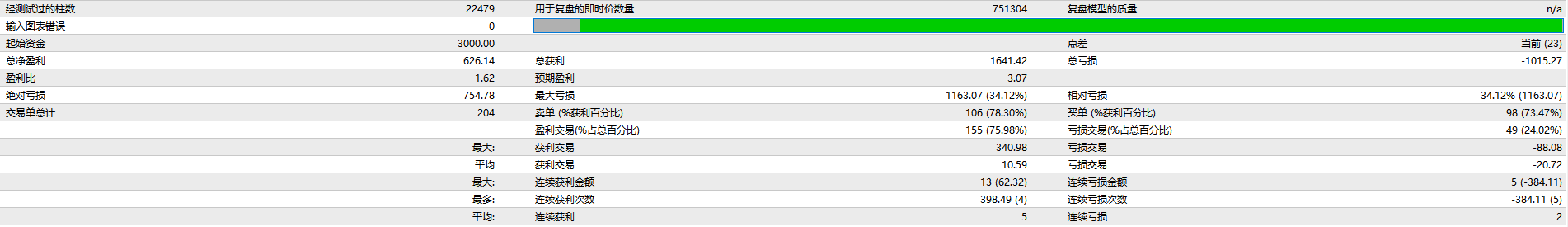

AUDNZD

| profitability | earnings yield (finance) | break-even ratio | maximum retracement | Total number of orders traded | Percentage of profitable trades | Percentage of losing trades |

| 626.14 | 20.87% | 1.62 | 34.12% | 204 | 75.98% | 24.02% |

NZDCAD

| profitability | earnings yield (finance) | break-even ratio | maximum retracement | Total number of orders traded | Percentage of profitable trades | Percentage of losing trades |

| 1324.64 | 44.15% | 2.4 | 9.21% | 273 | 80.22% | 19.78% |